Capital gains calculation

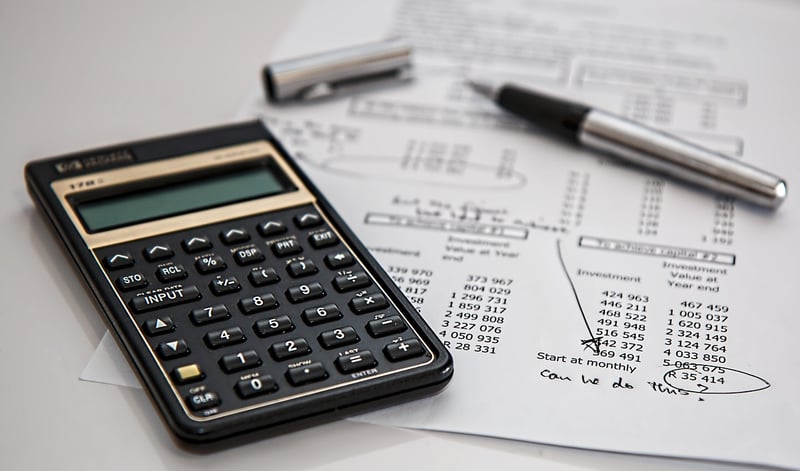

Tax Implications and Capital Gains Calculation

Understanding the tax implications of capital gains is crucial for investors and individuals involved in asset sales. Capital gains are the profits earned from selling assets such as stocks, bonds, real estate, or valuable items. These gains are subject to taxation, but the amount of tax owed can vary based on several factors.

Types of Capital Gains

Capital gains are categorized into two types: short-term and long-term. Short-term capital gains are from assets held for one year or less, while long-term capital gains are from assets held for more than one year. The tax rates for these two types differ, with long-term gains generally taxed at lower rates.

Capital Gains Tax Calculation

The calculation of capital gains tax involves determining the gain from the sale of an asset and applying the relevant tax rate. Here's a simplified formula for calculating capital gains:

- Determine the sale price of the asset.

- Subtract the asset's purchase price (cost basis) from the sale price to calculate the capital gain.

- Apply the appropriate tax rate based on whether the gain is short-term or long-term.

- Report the capital gains on your tax return.

Capital Gains Tax Rates

The tax rates for capital gains vary depending on your income level and the type of asset sold. Long-term capital gains are generally taxed at lower rates than short-term gains. It's essential to consult with a tax professional or refer to the latest tax laws to determine the exact rates applicable to your situation.

Impact of Capital Gains on Investments

Capital gains taxes can significantly impact your investment returns. It's essential to consider tax implications when making investment decisions to optimize your after-tax profits. Strategies such as tax-loss harvesting and holding assets for the long term can help minimize tax liabilities.

Conclusion

Understanding the tax implications of capital gains and knowing how to calculate them is vital for individuals managing investments or selling valuable assets. By staying informed about the tax rates and rules governing capital gains, you can make informed financial decisions and optimize your tax liabilities.